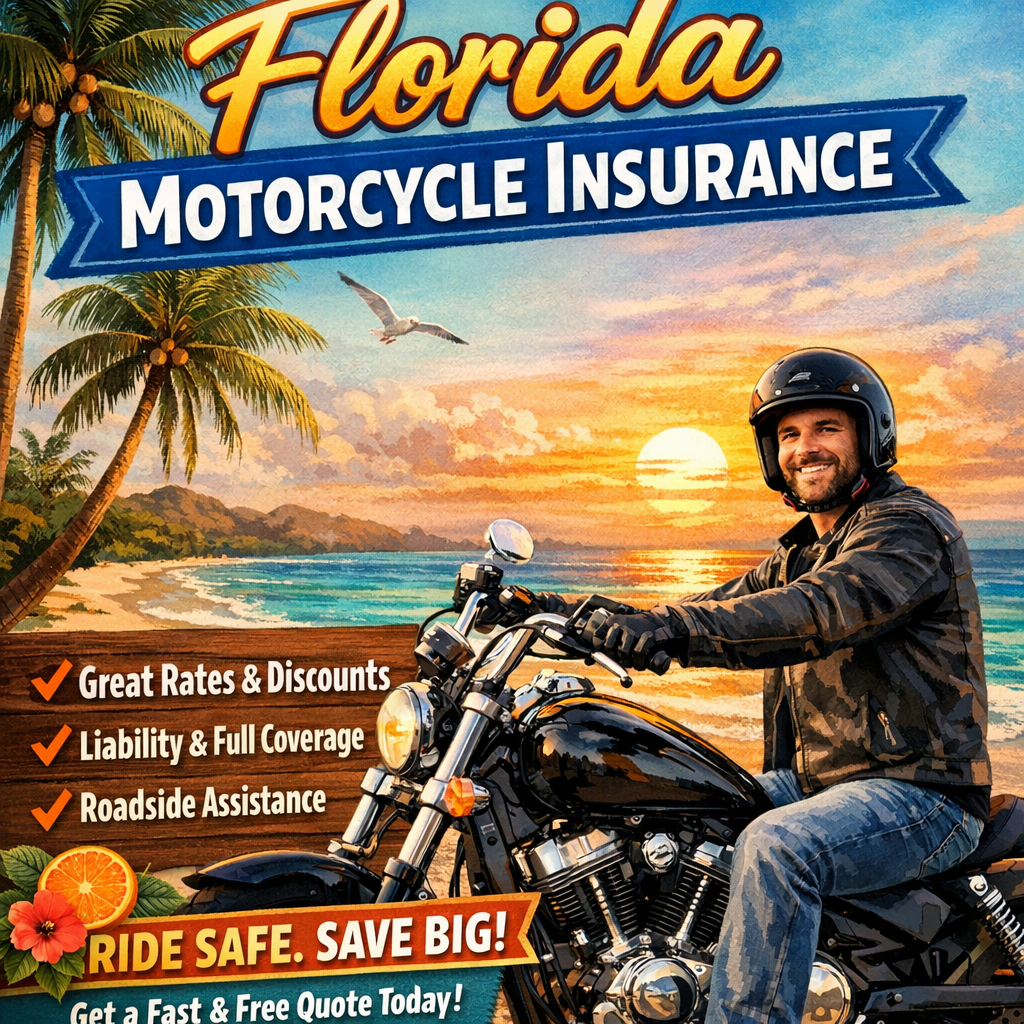

Riding a motorcycle in Florida offers a unique sense of freedom, but it also comes with certain responsibilities—one of which is obtaining proper motorcycle insurance. Unlike many other states, Florida’s insurance requirements for motorcyclists are distinct and sometimes confusing. Whether you’re a new rider or a seasoned enthusiast, understanding the essentials of motorcycle insurance can help you stay protected on the road and avoid legal troubles. This article breaks down everything you need to know about motorcycle insurance in Florida, from legal requirements to tips for saving money.

Understanding Florida Motorcycle Insurance Requirements

Florida stands out compared to many states because it does not require motorcycle owners to carry the same type of insurance as car owners. While automobile drivers must have Personal Injury Protection (PIP), motorcyclists are exempt from this rule. However, riders are still financially responsible for any injuries or damages they cause in an accident, making liability coverage a wise choice, even if it’s not mandated by state law.

If you’re involved in an accident and are found at fault, the financial burden can be significant. Florida law requires riders to provide proof of financial responsibility, which can be satisfied by liability insurance or a financial responsibility certificate. Failing to meet these requirements can result in license suspension, fines, and possible impoundment of your motorcycle.

Additionally, if you plan to ride without a helmet (which is allowed for riders over 21), Florida law requires you to carry at least $10,000 in medical benefits coverage through your health insurance or a separate policy. Understanding these requirements helps ensure you’re both legal and protected on Florida’s roads.

Types of Coverage Available for Florida Riders

While minimum liability insurance is often recommended, several other coverage options can give Florida riders peace of mind. Bodily injury liability and property damage liability are the most common choices, covering medical bills and repair costs for others if you’re at fault in an accident. These policies can help safeguard your assets from potential lawsuits.

Another important option is collision coverage, which pays for damage to your own motorcycle after an accident, regardless of fault. Comprehensive coverage is also available, covering non-collision incidents such as theft, vandalism, or weather-related damage—a smart choice given Florida’s hurricane-prone climate. These additional coverages can be especially valuable for those with newer or more expensive bikes.

Florida riders may also want to consider uninsured/underinsured motorist coverage. Given that some drivers on the road may lack adequate insurance, this coverage protects you and your passengers if you’re involved in an accident with an underinsured or uninsured motorist. With these options, you can tailor your motorcycle insurance policy to fit your specific needs and comfort level.

Factors Affecting Your Motorcycle Insurance Rates

Many factors influence how much you’ll pay for motorcycle insurance in Florida. Your age and riding experience play a significant role; younger, less-experienced riders generally face higher premiums due to increased risk. Likewise, your driving record can have a major impact—tickets, accidents, or previous insurance claims can drive your rates up.

The type and value of your motorcycle also matter. High-performance or custom bikes typically cost more to insure than standard models because they’re more expensive to repair and are often involved in more severe accidents. Where you store your bike, how often you ride, and even your ZIP code can affect your rates, as areas with higher theft or accident rates usually mean higher premiums.

Lastly, the coverage options and deductible amounts you choose will directly impact your bottom line. Opting for higher limits or lower deductibles provides more protection but comes at a higher monthly cost. Conversely, minimal coverage with high deductibles can reduce your premium but may leave you financially vulnerable after an accident.

How to Choose the Right Policy in Florida

Choosing the right motorcycle insurance policy in Florida starts with assessing your own needs. Consider how often you ride, the value of your motorcycle, and whether you have health insurance that covers motorcycle accidents. If you frequently ride in busy or high-risk areas, higher liability and uninsured motorist coverage may be wise.

Compare quotes from multiple insurance providers, as rates and coverage can vary widely. Pay attention not just to the monthly premium, but also to what’s covered and the claim process. Reading customer reviews and seeking recommendations from fellow riders can give you insight into each company’s reputation for handling claims and customer service.

Lastly, don’t hesitate to ask questions. An experienced insurance agent can help clarify the finer points of policies and ensure you’re meeting Florida’s legal requirements. Taking the time to find a policy that fits your budget and riding habits will give you confidence every time you hit the road.

Tips for Saving Money on Motorcycle Insurance

Saving money on your motorcycle insurance in Florida is possible with a few smart strategies. Bundling your motorcycle policy with other insurance products—such as auto or homeowners insurance—often leads to multi-policy discounts. Many insurers offer loyalty discounts or lower rates for paying your premium in full rather than in monthly installments.

Consider taking a motorcycle safety course, even if you’re an experienced rider. Completing an approved safety course can not only make you a better, safer motorist but also qualify you for premium discounts with many insurance providers. Maintaining a clean driving record is another reliable way to keep your insurance costs down over time.

Finally, adjusting your coverage and deductible amounts can impact your rates. If you have an older bike or only ride occasionally, you might opt for less comprehensive coverage. Raising your deductible—the amount you pay out of pocket on a claim—can also reduce your monthly premium, just make sure it’s an amount you can afford if you need to make a claim.

Conclusion

Motorcycle insurance in Florida comes with its own set of unique considerations, from differing legal requirements to a wide array of coverage options. By understanding the basics, evaluating your specific needs, and shopping around for the best policy. You can enjoy the open road with greater peace of mind—and possibly save money in the process.